2025 was a record year for million-dollar HDB resale flats in Singapore! As of mid-December, 1,544 such flats were sold – that’s about 50% more than the 1,035 in 2024. Experts expect the final count to hit around 1,550 by year-end. These are regular HDB flats (not private condos) selling for $1 million or more, mostly in central or mature areas.

Key Points in Simple Terms

- Top price: $1.659 million for a five-room flat at SkyTerrace @ Dawson (Queenstown) – the highest ever on HDB records.

- Most common: Four-room flats led with 646 sold (up 70% from last year), followed by five-room (536) and executive flats (357).

- Hot spots: Toa Payoh (296 deals), Bukit Merah (209), Queenstown (165). Popular blocks like The Pinnacle @ Duxton and newer flats in Bishan.

- Why so many?: Newer flats (10-15 years old) with long leases left, good locations near MRT/amenities, and modern designs. Buyers love central spots without new BTO restrictions.

- Average price: About $1.14 million – only up 1.8% from last year, showing buyers are careful not to overpay.

My Insights

These million-dollar HDB resales are still just a small part (around 6%) of all HDB sales – most flats are much cheaper. The big jump in 2025 comes from many good-quality flats hitting their 5-year minimum occupation period (MOP), especially in popular towns.

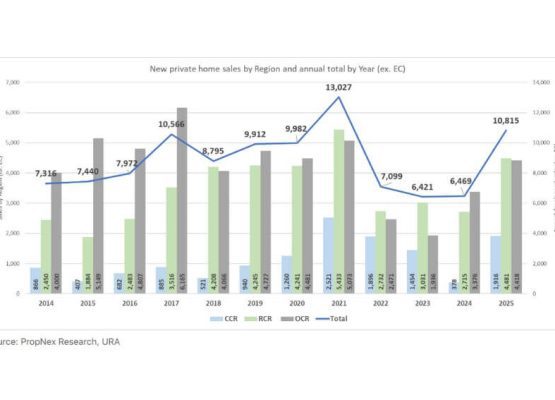

Looking ahead, 2026 might see even more (experts predict 1,400-1,800) because over 13,000 flats will reach MOP next year. But more supply could slow down price jumps. If you own an HDB in a central area, its value might keep rising steadily. For buyers, these premium flats offer “private home” feel at lower entry cost than condos – but check the remaining lease carefully!

Source: EdgeProp Singapore (December 2025).