While others fear a property bubble, savvy investors are quietly entering Singapore’s “Goldilocks” phase. Prices are moderating and demand is resilient—but do you know which segments will actually lead the growth of Singapore property market 2026?

The Singapore property market 2026 is entering a “Goldilocks” phase, characterized by resilient demand and moderating prices. This balanced trajectory in the Singapore property market 2026 fosters sustainable conditions for both buyers and sellers.

Drawing from the latest PropNex data and January 2026 launch results, this analysis explores why the current “just right” conditions are set to define the year ahead.

2025 Review: Price Moderation and Resilience

Before looking forward, we must acknowledge the cooling trends of 2025 that paved the way for current stability.

Private Home Performance

Private home prices grew by 3.3% in 2025, the slowest annual increase since 2020. This moderation was driven by a shift toward owner-occupier demand in the Rest of Central Region (RCR) and Outside Central Region (OCR).

| Segment | Annual Growth (2025) | Q4 2025 Change |

| Landed Properties | 7.6% | +3.4% |

| Non-Landed (Overall) | 2.3% | -0.2% |

| Core Central Region (CCR) | 1.9% | -3.5% |

HDB Resale Market: First Flat Quarter

In a historic shift, HDB resale prices recorded a 0.0% change in Q4 2025—the first unchanged quarter since the pandemic began. Total annual growth slowed to 2.9%, signaling a much-needed breathing room for buyers after years of double-digit spikes.

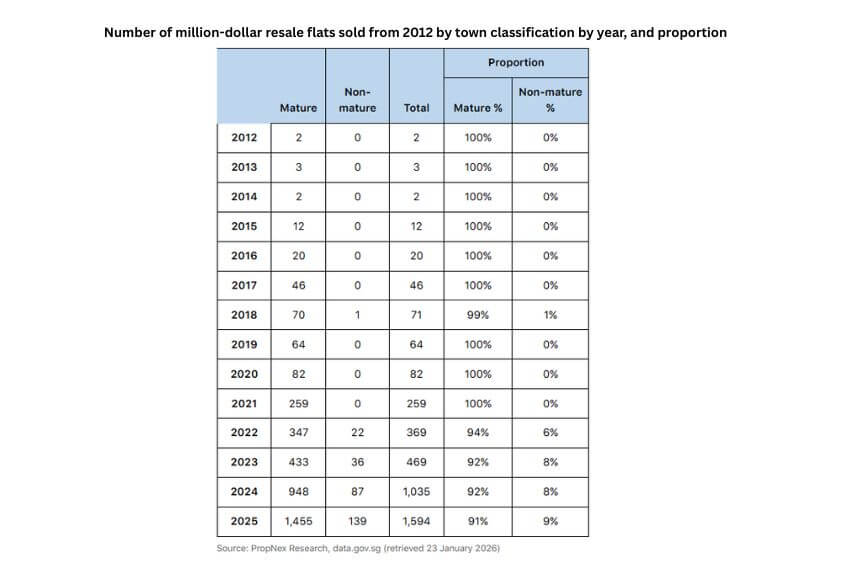

The Rise of Million-Dollar HDB Transactions

Despite overall price moderation, the “prestige” HDB segment remains white-hot. A record 1,594 million-dollar flats were transacted in 2025, a massive 54% jump from 2024.

- Mature Towns: 91% of these deals happened in areas like Toa Payoh, Bukit Merah, and Queenstown.

- Non-Mature Growth: Towns like Hougang (45 units) and Woodlands (29 units) are increasingly seeing million-dollar tags as buyers prioritize space and newer MOP (Minimum Occupation Period) status.

Strategic Outlook for the Singapore Property Market 2026

The “Goldilocks” sentiment is expected to persist throughout 2026, supported by a favorable interest rate environment. The 3-month Compounded SORA has stabilized (around 1.14% to 1.22%), making mortgage planning more predictable.

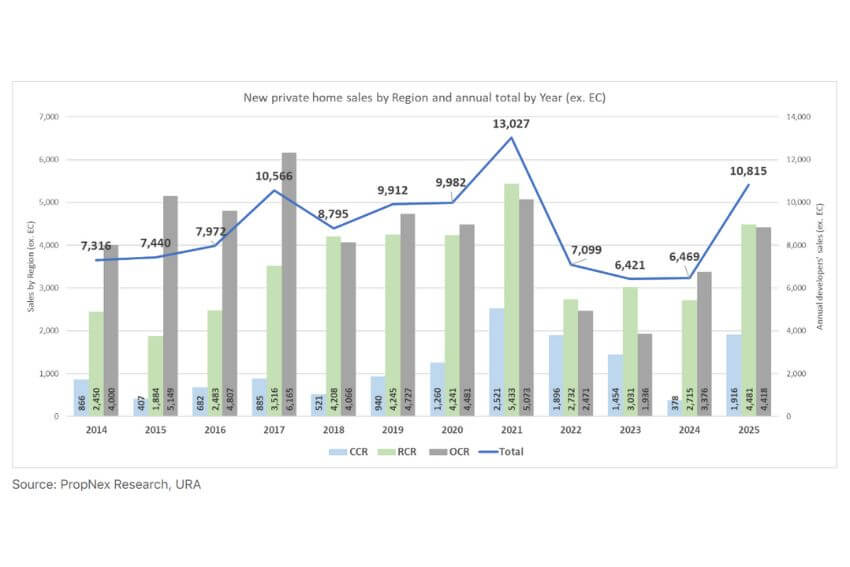

1. Private New Launches and Sales

We anticipate new sale volumes (excluding ECs) to reach between 8,000 and 9,000 units. A leaner supply pipeline of approximately 8,800 units across 23 projects will likely keep prices firm but not explosive.

Key Early 2026 Launches:

- Narra Residences: (Dairy Farm Walk) Opened for preview Jan 17, 2026, with prices starting from $998,000.

- Newport Residences: A rare freehold luxury project in the CBD, setting the tone for the high-end market.

2. The Executive Condominium (EC) Surge

2026 is shaping up to be a “banner year” for ECs. The Coastal Cabana EC launch on January 17–18, 2026, proved the immense hunger for this segment, selling 67% of its 748 units on opening weekend at an average of $1,734 psf.

3. HDB Resale Supply Spike

A critical factor for 2026 is the surge in MOP flats. Approximately 13,500 units will reach their 5-year MOP this year—a 69% increase from 2025. This influx of relatively new resale stock will likely:

- Stabilize price growth within the 3–4% range.

- Provide HDB upgraders with more options in the secondary market.

Conclusion: A Favorable Window for Buyers

The Singapore property market in 2026 is no longer about “chasing the peak.” Instead, it is a market of rationality and selection. With interest rates easing and a healthy pipeline of both HDB and private homes, buyers have a unique window to make calculated moves.

Whether you are looking for a “future-proof” freehold asset in the CBD or a rare sea-facing EC in Pasir Ris, the 2026 market offers a balanced path forward.